A Look Into Seed-Stage Venture Sidecar SPVs

Background on SPVs and Sidecar Funds

SPV stands for Special Purpose Vehicle, also known as a sidecar fund. It is a legal entity set up to accomplish a special or single investment-related purpose. In angel and venture capital investing, it is primarily used to pool money for investing in a single deal. The term sidecar implies that there is a lead investor who sourced the deal, performed due diligence, is investing directly in the entity, and is usually putting their name and brand behind the deal. The lead investor, known as the organizer, typically receives compensation in the form of management fees and/or carried interest.

Sidecar SPVs are typically deployed by venture capital (VC) funds to fill a fund’s pro-rata allocation in a funding round where the fund’s structure limits how much capital the fund can allocate to that deal. By way of example, imagine a $20M micro-VC seed fund that backed Uber in its seed round, trying to fill its pro-rata investment in Uber’s $1.4B Series D round. It probably couldn’t afford to invest its full pro-rata, but it’s likely that its limited partners (LPs) could. In cases like this, the fund may set up a sidecar SPV so its LPs can invest in those future rounds, taking advantage of the fund’s pro-rata rights.

Angel investors may also be familiar with sidecar SPVs under a different name – an angel syndicate or angel fund. The AngelList Syndicate structure is simply a sidecar SPV where the lead investor is an angel investor or emerging VC manager raising capital on a deal-by-deal basis instead of for a committed fund. Syndicate investors value the access to the lead investor’s deal flow and diligence and pay a success fee in the form of carried interest.

How Sidecar SPVs Fit into Companyon’s Investing Model

At Companyon Ventures, our model is to secure additional allocation in deals for a sidecar SPV when it makes sense, starting with our initial investment in the company.

Why do we do this?

Many of our LPs are active early-stage investors who generally aren’t getting pitched by post-seed stage companies. Allowing our LPs to co-invest in our deals whenever possible is one of the core elements of our fund strategy.

Sidecars afford us greater access to deal flow, especially with deals on the larger end of the post-seed spectrum. An example of this is our recent investment in RoadSync alongside Base10 Partners and HydePark Venture Partners (both are larger funds than ours). Without our RoadSync sidecar SPV, our fund’s check size wouldn’t have filled the round, and the company likely would have opted to take money from a larger fund.

We have many talented investors in our network who don’t want to invest in a fund, but have expressed interest in investing in certain types of deals. Collaborating with those people via SPVs allows us to build stronger working relationships than would otherwise be possible. Those investors become advocates for Companyon.

How Do Founders & CEOs View Sidecar SPVs?

The sidecar SPV process is largely invisible to the companies we invest in. Other than having one more entry on the cap table, there is no added complexity to the deal process. This is because we make an effort to shield the company from extra work related to the sidecar: we share our fund’s investment memo and detailed due diligence with sidecar investors; arrange for a single live video-based pitch session and Q&A with the CEO; and record the meeting for the benefit of those investors who didn’t attend the live pitch.

While most post-seed CEOs wouldn’t consider pitching to a large number of small $10K – $25K checks in a $4M round, our process allows for those investors to participate without adding complexity or inundating the CEO with a flurry of questions and information requests.

Pros & Cons for Sidecar SPV Investors

Pros

SPV investors can include a variety of personas from the organizer’s network, including the fund’s LPs, angel groups, family offices, angel investors, and even existing investors in the company. Each of these personas has a different relationship with the organizer and likely has a unique perspective on the SPV opportunity. Regardless, all SPV investors can capitalize on these benefits:

- Deal Flow: Many individual investors are limited to local investments or those found through their personal networks. SPVs organized by venture funds with broader geographical or sector focus can diversify the investors’ reach through the fund’s strategy and deal-sourcing engine. Investors can connect with companies at the early expansion stage when they are no longer pitching individual investors, family offices, or crowd equity sites. Usually, these companies are looking for institutional investors who can help them with the challenges of early scaling.

- Professional Diligence: Most institutional investors perform a level of diligence that individual investors can’t. Best-practice SPV organizers provide sidecar investors with access to a comprehensive internal due diligence package performed by the investment team. They share transcripts of their customer diligence calls, independent market sizing, metrics modeling and benchmarking, as well as forecast and financial analysis.

- Infrastructure: Unless there’s a management fee, SPV investors generally don’t have to share the out-of-pocket costs the fund has incurred to source, perform diligence, and close the deal, including tax advice, legal fees, travel, staff, and research expenses. These are the hidden expenses of VC funds that individual investors often don’t think about when vetting sidecar opportunities.

- Deal Terms: SPVs should invest in a company on the same terms as the fund does. As I have learned from angel investing, small investors are often excluded from certain major investor rights (pro-rata rights, information rights, etc.) as the company raises later-stage capital from institutional investors. As an SPV investor, it’s important to make sure that the SPV qualifies for major investor rights and is covered by a side letter or under the “Affiliate” definition in the deal’s Major Investor definition (if it exists, it will be found in the Investor Rights Agreement).

- Passionate Advocate: As a lead investor in the deal, the SPV organizer is usually a significant investor, board member, and a committed steward of the investment who will distribute regular reporting, advise on pro-rata participation, and represent SPV shareholder interests because they are aligned with the organizer’s own fund interests.

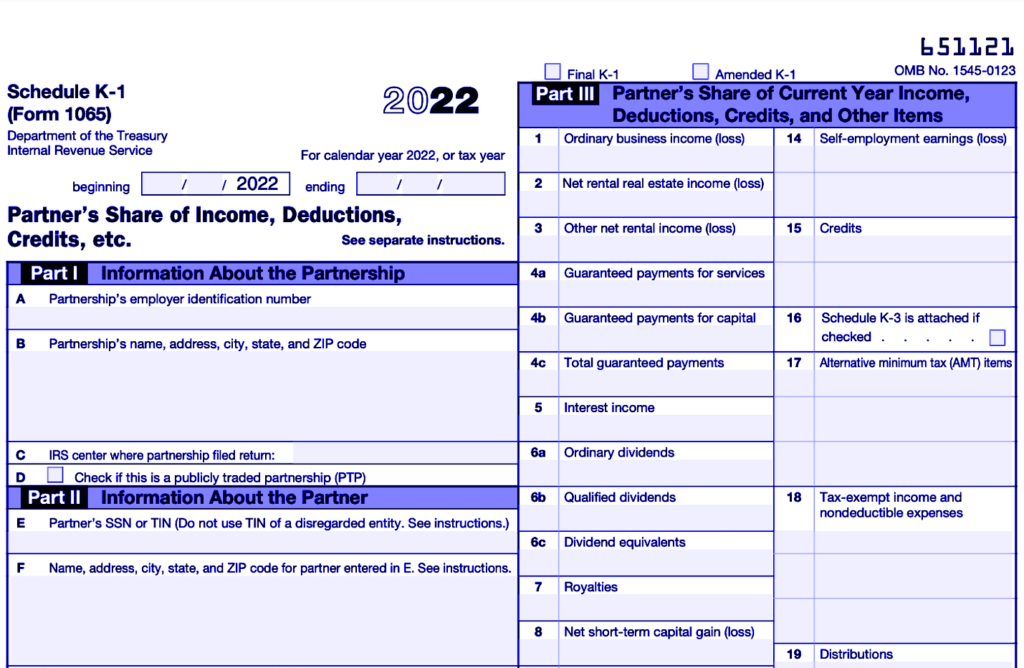

- No Loss of Tax Benefit: Most SPVs are Delaware LLCs which are pass-through entities and preserve Section 1202 tax benefits. Also, check to see whether or not the SPV will issue annual K1 statements. SPVs can be structured so they don’t issue K1s until there’s a taxable event.

Cons

- Limited Founder Connections: Early-stage investors like to cultivate relationships with amazing founders throughout their startup journeys. While nothing about an SPV investment inherently blocks you from building those relationships with companies, it usually means someone else spent the time cultivating the relationship and you’re likely tagging along as a passive investor.

- No Hands-on Mentorship: As a lead investor in the deal, the SPV organizer is usually a mentor to the CEO as a major investor and board member. Hands-on investors who like to work with the founders they invest in will probably not have a hands-on advisory role with the founding team unless it’s facilitated by the SPV lead.

- Fees / Carry: Most sidecar SPVs draw setup fees, management fees, or carried interest in exchange for some of the benefits listed above. Some potential SPV investors, especially those with their own fee/carry structure may find this structure incompatible with their own investing strategy.

SPV Platform, Structure, Fees, & Carried Interest

We field a lot of questions from other micro VCs about how we structure our sidecar SPVs and how we can afford to administer them with relatively small SPV sizes (<$500k). Of particular interest is how we structure sidecar fees and carried interest. We spent a lot of time thinking about fairness to all parties involved and how to align our interests with those of the company, our LPs, and outside investors.

Efficient SPV Structure & Administration

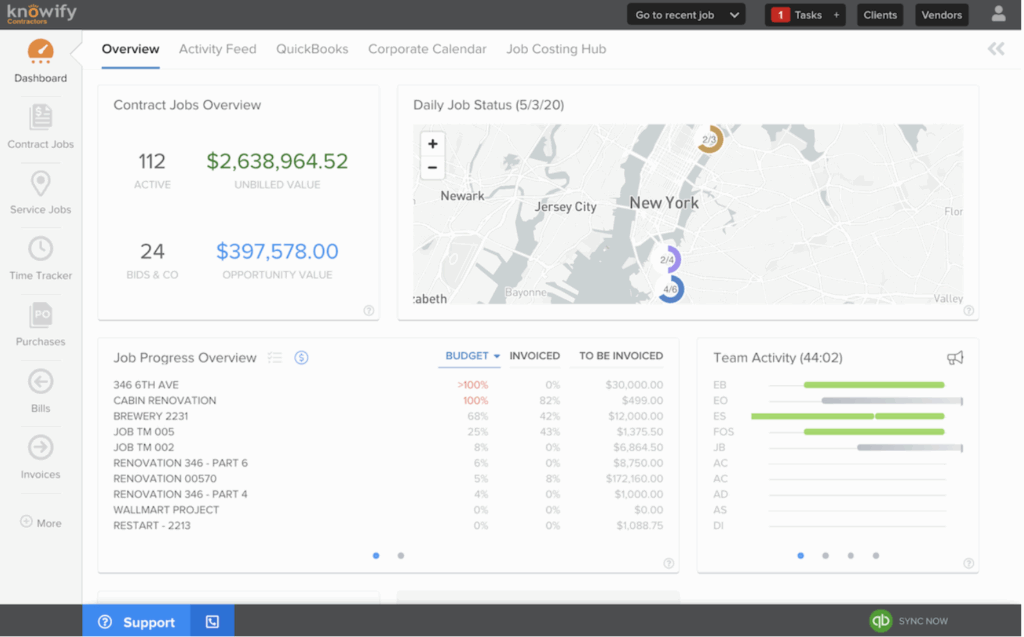

Our first decision was around whether to organize and manage the SPV using our own lawyers and accountants, or use a fully-managed outsourced SPV platform. With our small SPV sizes, we picked the latter and selected AngelList because we found the expenses to be very reasonable, and most importantly, a fully managed platform frees us from the distraction of managing the back office of many sidecars. Over the life of several funds and potentially dozens of investments, we don’t want to add SPV administration to our workload or allocate resources from our scarce fund management fees.

Management Fees

The required effort and cost to launch and administer an SPV may require some general partners (GPs) and SPV organizers to build in a management fee. We decided not to charge management fees because the ongoing management of the SPV doesn’t require us to do anything that we’re not already doing for our investments and LPs. We do field questions from SPV investors during the onboarding process, but we’ve found that burden to be nominal.

Carried Interest

A pretty standard carry in Venture Capital SPVs is 20% after 1x the investment is returned. We know many investors who have participated in sidecar deals and/or AngelList Syndicates, understand the structure, and are happy to benefit from our fund’s infrastructure and only pay carried interest on successful outcomes. We’ve also encountered some investors who have an exclusive model of direct investing and won’t invest in SPVs that come with carried interest obligations. Some investors have walked away from our deals solely over this issue, especially when those investors are also paying their own angel group membership fees and/or have built their own deal sourcing networks.

Fund LPs: To Discount Carried Interest or Not?

SPV carried interest for LPs presents some interesting challenges for GPs. LPs in most funds are paying the standard 2/20 (2% management fee + 20% carried interest) on their investments in that fund (or something close to it). In speaking with other fund managers who organize SPVs, we’ve heard everything from 0/0 to 1/20, depending on the fund’s overall economic model. We opted for a middle ground, giving fund LPs a discount on a carried interest. The reasoning behind this is that they are effectively underwriting our firm via the fund’s management fees, which allow us to organize SPVs in the first place. Once non-LPs who invest in our SPVs understand the reasoning behind this discount, they are amenable to the structure.

What About Existing Company Investors?

We waive the carried interest for existing company investors because we think it’s fair. They didn’t benefit from our sourcing or our diligence; they would have made the investment with or without us. One could make the argument that existing investors are unfairly getting the benefit of the SPV major investor rights for free, but it’s important to us that CEOs keep healthy relationships with their existing early investors. Forcing an existing investor into a vehicle where they pay fees or carry to a new investor just seems wrong.

GPs considering a sidecar SPV strategy, including stakeholders other than LPs should think carefully about a fee structure that’s equitable for all parties involved. We err on the side of transparency with our SPV investors, especially as it pertains to discounts and waivers on carried interest.

GP / LP Alignment

When thinking through an SPV strategy, it’s important to align interests between the fund and its LPs. Winter Mead does a great job of exploring this issue in this article. The most obvious issue for consideration is the financial compensation for GPs from fund performance vs. sidecar exits. GPs typically don’t earn carried interest until 100% of the principal and expenses invested in the entire fund are returned to LPs. Conversely, GPs can earn carried interest on a single SPV deal. This means that GPs can start earning carried interest on SPV exits long before the fund hurdle rates are achieved, something that may bother LPs depending on the magnitude.

To help align interests, GPs should consider the following approaches when adopting an SPV strategy:

- LP Disclosure: If you have a sidecar strategy, make it obvious to LPs from the get-go what your strategy is and how it will be structured.

- Oversubscription Priority: If a sidecar SPV is oversubscribed, LPs should get a right of first refusal for the investment with allocations proportionate to each LPs commitment to the firm’s fund.

- SPV to Fund Investment Ratios: Unless it’s an explicit part of your fund strategy, consider limiting your initial sidecar investment in a company to no more than 50% of your fund’s initial investment. Over time, this should create a correlation between the aggregate SPV performance and the fund performance, mitigating the concern or the optics to LPs that you set up your fund for the purpose of generating SPV deal flow.

- Fair and Consistent Fee/Carry Structure: LPs want to know that SPV terms are fair to them and consistent from deal to deal; ensuring managers are not weighting the success of any particular portfolio company over another, or exploiting their fund investment for the benefit of outside investors who don’t have a vested interest in the firm’s success.

I hope this perspective is valuable. If you’re a syndicate lead or seed-stage venture capital fund manager who has a sidecar strategy, we’d love to hear from you and learn what’s worked and hasn’t worked with your sidecar funds.

Our Resources

Get access to free tools to help accelerate your company’s growth, regardless of a future partnership with Companyon—because, we’re here to help.

Our Newsletter

Join our newsletter for helpful guides, expert insights and company updates delivered monthly to your inbox.

Blog

Blog