Why We Invested in Knowify After Passing on Their Seed Round

Many VC blogs have been written about why or why not founders should nurture relationships with VCs who pass on their seed rounds. Our relationship with Marc Visent, Co-Founder and CEO of Knowify started in 2019, long before we co-led Knowify’s $5.4M Series A round alongside MassMutual Ventures in October of 2021.

My partner, Parthib, was introduced to Marc by a mutual connection in 2019 when Knowify was raising its seed round. Marc pitched us. We passed because the company was too early for us at the time. How did Marc re-engage us? Before I describe Marc’s fundraising playbook that every post-seed founder should follow, here’s why we co-led Knowify’s Series A round.

What is Knowify?

If you’ve hired a contractor recently, you probably had a very common experience where the on-premise work was excellent but the business and back-office interactions were downright frustrating and antiquated. Consumers and businesses alike have grown to expect seamless digital experiences like Venmo, Uber, and DoorDash, yet in the world of small and medium construction companies, business is still primarily conducted by telephone, email, and paper checks. When you consider the B2B relationship between a general contractor and a subcontractor, the inefficiencies and frustrations are magnified.

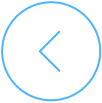

The back office of a small or medium construction company is usually run by an admin or accountant who is struggling to keep up with bids & estimates, job scheduling, invoicing, approvals, vendor payments, permitting, collections, and bookkeeping. As a result, the business owner doesn’t have a clear picture of the detailed status of active jobs or the current financial health of the business beyond today’s bank account balance.

When you consider that there are over 2 million small and medium contracting businesses just in the US, that amounts to a staggering level of inefficiency, lost profits, owner anxiety, and customer frustration in the industry.

Knowify automates it all and seamlessly integrates with accounting software like Intuit’s Quickbooks Online, who has partnered with Knowify to bundle Quickbooks + Knowify for construction companies to deliver a full workflow and financial suite. The beauty of Knowify is that it’s as simple to use as any mainstream consumer application. Knowify delivers powerful automations and analytics that eliminate phone calls, emails, and paper-pushing while showing business owners which jobs are delivering their profits and what their complete financial picture looks like at any moment in time.

Why Did We Invest in Knowify?

Our experience with CEO, Marc Visent was a huge part of why we invested. He’s passionate and persistent, transparent, self-aware to an extreme degree, and has a deep understanding of the company’s metrics and KPIs.

At Companyon Ventures, we focus a lot on helping our companies with go-to-market execution. Usually at our stage, we see significant gaps in how well companies are messaging and positioning their product and targeting their ideal customer profile. Many times, seed-stage companies haven’t done a customer segmentation analysis and aren’t sure where their sales and marketing dollars are generating the most ROI.

We were impressed with how far along Knowify was in these areas even without a CFO, sales leader, or marketing leader. This was a signal of how disciplined Marc and his co-founder Dan DeRoulet were in building Knowify and their metrics-driven culture. How did we learn all of this after passing on Knowify’s seed round? We followed Knowify’s progress over 18 months because Marc didn’t write us off after we passed on their seed round (lucky for us!).

The Post-Seed VC Nurture Playbook

Here’s a quick summary of a low-impact playbook for nurturing VC relationships for your post-seed or Series A round. When I say nurturing, I really just mean sending email updates to relevant VCs who passed on your seed round. It’s important to point out that you should only nurture relationships with VCs who passed specifically because they said you’re too early. Don’t bother with VCs who passed because of your industry, business model, or those who just went radio-silent on you.

Most VCs use CRM systems to track prospect companies. At Companyon, it’s really helpful to us when we can track your progress over time. We’re getting visibility into your progress and the evolution of your strategy, pricing, and positioning over time. Essentially, we’re monitoring the maturity of your product-market fit. We also use that time to try to be helpful and promote our potential value to you.

Here’s a simple post-seed nurture playbook to help you streamline your Series A fundraise:

- Build a list of relevant VCs that you met with who considered you too early for them but expressed interest in staying in touch.

- Circulate brief periodic updates on your business (I recommend quarterly or semi-annually). When I say brief, I mean 2 or 3 short paragraphs including any major announcements, team developments, product launches, and definitely include some tangible revenue or traction metrics. Automate this activity with a mailing list- don’t use your valuable time crafting personalized emails.

- If you’re not fundraising, don’t take meetings… to a point. Avoid associates looking to “catch up” or “get an update.” That’s a waste of your time. However, if there’s a VC partner who is genuinely interested in your business, offering help, or wants to spend time with you, this means they’re positioning themselves to potentially pre-empt or lead your next round. It’s not a bad thing to build that relationship to see if it’s the type of person you want on your board for the next four years.

- When you’re preparing to fundraise, reach out to your nurture list and tell them that you’re about to start fundraising. Include a business update, slides if you have them, and be explicit about how much you’re raising. Interested firms who are tracking you will quickly engage. In our case, when Parthib on our team received Marc’s email about his Series A raise, Parthib advocated for Knowify in our team’s deal pipeline review meeting. He already knew a lot about the business so he didn’t have to do a lot of investigatory research to find conviction.

Knowify did a great job with their VC nurture campaign and we’re grateful that they did!

Our Resources

Get access to free tools to help accelerate your company’s growth, regardless of a future partnership with Companyon—because, we’re here to help.

Our Newsletter

Join our newsletter for helpful guides, expert insights and company updates delivered monthly to your inbox.

Blog

Blog