Why We Invested In Bento

Dental insurance might be a lot cheaper than health insurance and give people a lot less grief, but underneath the surface is an antiquated industry that is wildly inefficient. That’s why we have chosen to invest in Bento, a self-insurance, digital marketplace that connects patients, payers, and dentists in one network.

Bento is looking to disrupt the age-old $16 billion dental insurance market by leveraging technology to remove the middlemen — the legacy dental insurance companies. The company is also catering to the tens of millions of people that don’t have dental insurance.

Luckily, this herculean effort is being led by Ram Sudireddy, a visionary CEO with loads of experience building great companies and disrupting large markets. Here is why we believe Ram and his team at Bento have found a huge gap in a massive market.

The Pain Point In Dental

While we are not here to argue that dental insurance is a bigger headache in people’s lives than health insurance, there is no denying that health insurance is actually a much better deal — and exponentially so.

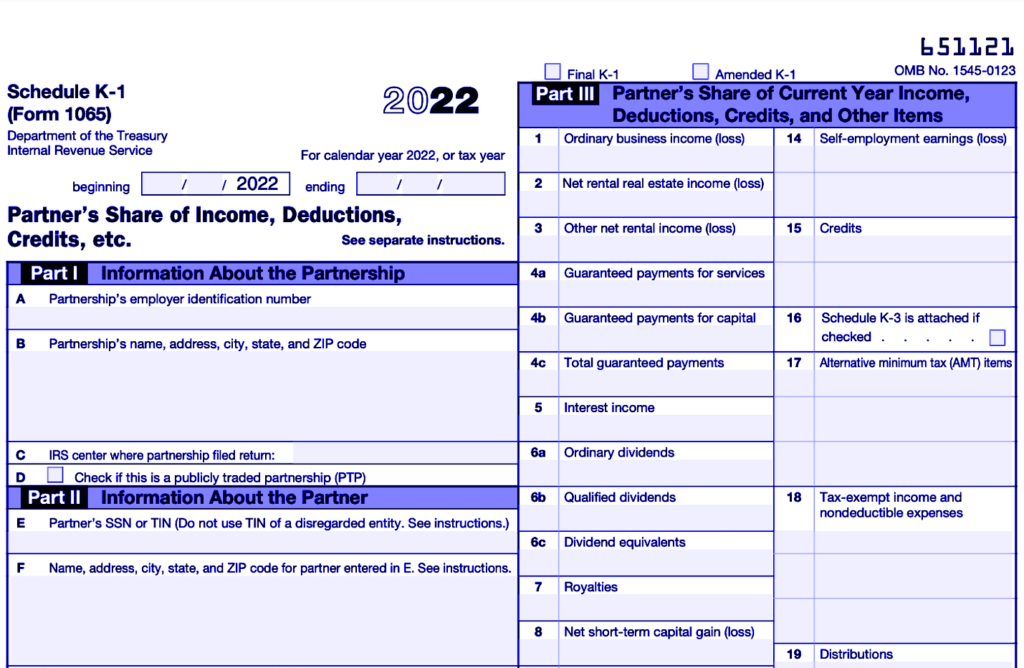

Yes, the average individual pays $6,000 annually in health insurance premiums, compared to just $500 annually for dental, but health insurance covers millions of dollars in potential treatment should you ever have a serious medical condition such as cancer. Conversely, dental insurance normally only covers up to $1,500, and you probably have to spend thousands in premiums over multiple years even to qualify.

Additionally, once you get a little older and start making a few trips to the doctor, you quickly realize just how expensive everything can get and how important it is to have health insurance.

Dental insurance, on the other hand, is barely used. 97% of dental insurance customers do not reach their annual coverage maximum, leaving employers and plan sponsors wasting tens or hundreds of thousands of dollars each year. Up to 80 million Americans are uninsured or underinsured on the dental front.

All of this brings us back to the conclusion that while dental insurance seems like a good deal, it’s actually not very practical.

That leads us back to our recent investment in Bento, which we believe is challenging standard conventional offerings from legacy dental insurers that have for too long failed to innovate. It does this in several ways:

- Associations and Employers can design custom coverage plans for their members and employees without the constraints of insurance plans

- Associations can offer their uninsured members discounted dental coverage

- Employers can offer their employees total control over how to use the dental benefits provided by their company

- Employers only pay when dental services are used, and and avoid paying for unused benefits

- Dentists can offer Office Plans directly to uninsured patients through a Shopify-like experience

- Individuals and families can use Bento-for-life between jobs and post-retirement to benefit from discounted service rates

Bento brings it all together with a sleek digital platform that includes a portal for consumers to select and purchase plans; a member app that allows individuals to manage their coverage and appointments; and a portal for dentists to manage appointments, payments and feedback.

An Attractive Market

Aside from the ingenious concept and sleek digital interface, as we mentioned at the very beginning, our primary thesis around Bento is the vast market the company is disrupting. Most insurance businesses reach large markets because almost everyone needs insurance, regardless of industry or geography.

In the nearly $16 billion U.S. dental insurance market, Bento is aiming at a serviceable addressable market of $7.6 billion.

Not only is this a compelling market size for the company to target, but Bento is approaching its go-to-market strategy in a way that perfectly aligns with Companyon’s investment thesis, which seeks companies that sell to businesses and not directly to consumers (B2B).

Bento’s main focus today is selling group plans to employers, typically with less than 2,000 employees, and associations with large memberships. The company has already had several victories on this front, winning contracts with multiple associations and third-party administrators.

Bento’s B2B value-add is extremely compelling because of how much it can save small businesses and association members.

By switching to Bento, a typical 300-enrollee company will realize savings of nearly $83,000 per year, while a 2,000-enrollee company will see savings north of half a million. There is also minimal disruption because companies can keep much of their enrollment process the same and employees don’t have to change their dentists.

Bento’s secondary focus is pitching dental membership plans to high-volume dental offices that can help capture the 80 million Americans without group dental benefits. What better way to connect with these hard-to-reach customers than at the point of sale. Bento has also set up a Shopify-like experience for dentists to market themselves to the growing audience on the platform — it certainly helps that Bento is the only American Dental Association-endorsed solution for dental self-insurance.

Thus far, Bento has built a national dental network close to 100,000 strong and is starting to catch up to some of the large legacy insurance providers.

The savings Bento can help employers achieve, coupled with the ability to capture the uninsured market, makes the company an attractive growth story that we believe can significantly ramp up revenue in future years.

Always Invest In The Team

Regardless of the opportunity, every investor needs to trust and believe in the founders and team running the company. Fortunately, this was an easy box to check with Bento Founder and CEO Ram Sudireddy.

Sudireddy is an experienced serial entrepreneur who has launched and sold numerous startups. He was chairman of the board of directors at the IT recovery software company Sanovi, which IBM later acquired. He then founded and served as CEO and chairman of CHIL Semiconductor, which later got acquired by International Rectifier. Sudireddy then founded and served as CEO for Cimaron Communications, which AMCC acquired.

What stuck out to us is how Sudireddy can apply his technological skills and expertise across various industries. That shows how capable he is of understanding different markets and ecosystems and finding the cracks that can make them more efficient for many stakeholders across the supply chain.

The clever solution Bento has created and the large-scale market opportunity, as well as the founding team and alignment with our investment thesis, made Bento an easy investment for Companyon Ventures to pull the trigger.

Our Resources

Get access to free tools to help accelerate your company’s growth, regardless of a future partnership with Companyon—because, we’re here to help.

Our Newsletter

Join our newsletter for helpful guides, expert insights and company updates delivered monthly to your inbox.

Blog

Blog