At Companyon Ventures, we’re passionate about backing ambitious B2B software founders ready to scale. We look for that magic combination of product-market fit and the hunger to build something truly significant. Often, the conversation around scaling revolves around organic growth, and that’s crucial. But what if we told you there’s a powerful, frequently overlooked lever that even early-stage companies with under $10 million in ARR and limited capital can pull to accelerate their journey?

We’re talking about Mergers & Acquisitions (M&A).

For many Series A founders, acquiring another company might seem like a distant dream, reserved for well-funded giants. But as we recently learned in Companyon’s “Lunch & Learn” featuring experienced acquirers and portfolio CEOs Ryan Westwood, of Fullcast, and Zaid Rahman, of Flex, the landscape is shifting. Fullcast is a Go-To-Market Cloud to plan, execute, and track your GTM strategy. Flex is a hyper-growth fintech company supporting small and medium businesses (SMBs) with a new generation of banking and payment solutions. These dynamic leaders shared compelling insights into how even relatively early-stage companies can strategically leverage acquisitions to fuel growth, acquire new capital, and gain a competitive edge.

So, how can you, as a founder of a burgeoning software company, start thinking about M&A not as a far-off possibility, but as a viable and potentially game-changing strategy? Let’s dive into the key considerations.

Build vs. Buy – When Does Acquiring Make More Sense Than Building?

The classic dilemma: should you build a new feature or product in-house, or acquire a company that already has it? Ryan Westwood, who intentionally accelerated Fullcast through acquisitions from day one, offers a powerful perspective: start with the customer and work backward.

When Fullcast’s customers expressed a need for commissions software, Ryan’s team recognized that building it from scratch would take significant time and expertise – around three years. Instead of embarking on that lengthy journey, they looked for acquisition targets. This “buy” decision wasn’t about avoiding hard work; it was about strategically delivering value to customers faster and more efficiently. As Ryan aptly put it, point solutions can struggle against larger players, and offering more value through a broader suite of products leads to longer-term contracts and greater revenue growth within the existing client base.

Zaid Rahman at Flex echoed this sentiment. To build their vision of an “operating system for business owners” encompassing a wide array of financial services, they realized a combination of in-house development and strategic acquisitions was the most effective path. Their acquisition of Ghost Financial brought in specific fintech expertise and a small book of business, accelerating their capabilities in the restaurant industry. Similarly, the recent acquisition of 16z-backed Maza provided Flex with consumer fintech DNA and a high-performing growth team, allowing them to expand into the personal finance space for business owners rapidly.

The takeaway: If your customers are clearly asking for a specific capability, and acquiring a company with a proven solution allows you to address that need significantly faster than building it yourself, M&A becomes a compelling option. Moreover, acquiring can be a strategic move to create a more comprehensive offering if the competitive landscape favors broader platforms.

Getting Buy-In – Aligning Investors, Board Members & Employees

The prospect of an acquisition, especially for an early-stage company, can raise questions among stakeholders. How do you get your investors, board members, and employees on board?

Ryan emphasizes the importance of demonstrating a clear strategic rationale, rooted in customer demand. When investors can see how a potential acquisition creates synergies, drives revenue growth, and aligns with the overall vision, they are often happy to provide funding. Combining financial statements to illustrate the potential of the combined businesses can be a powerful tool. Furthermore, being creative with financing options beyond just cash – including venture debt and stock – can make acquisitions more accessible.

Internally, communication is paramount. Ryan stresses the need to create a compelling “better together” story. Focus on how the acquisition benefits employees, creates new opportunities, and strengthens the company’s overall position. The energy and enthusiasm of the CEO of the acquired company are also critical; their positive outlook can significantly impact the success of the integration. Consistent communication post-acquisition, reiterating the synergies and the “better together” vision, helps ensure everyone stays aligned and motivated.

Zaid’s experience highlights that acquisitions can even strengthen your balance sheet in certain scenarios, allowing you to acquire capital by giving investors preferred equity with significant long-term upside. This creative approach can align incentives and provide venture-like returns without a massive upfront cash investment.

The takeaway: Clearly articulate the strategic rationale behind the acquisition, focusing on customer benefits and potential synergies. Proactively communicate the vision and the positive impact on all stakeholders, and explore creative financing options to demonstrate feasibility.

Finding the Right Targets – How to Source & Vet Potential Acquisitions

Identifying the right acquisition target is crucial. Both Ryan and Zaid shared valuable insights into their approaches.

Ryan’s initial due diligence focuses on fundamental aspects: how is the target funded? What does their board look like? Understanding these dynamics early on helps avoid potential risks and distractions. He also prioritizes working with CEOs he trusts and prefers streamlined processes, often avoiding deals involving bankers for smaller targets (under $20 million ARR). Building relationships and leveraging existing networks can facilitate smoother deals, especially if you have connections with board members or trust the CEO. Ultimately, after identifying a product you want, understanding the target’s structure is key to a streamlined process.

Zaid, while emphasizing organic growth as their primary driver, looks at peers in their industry. As Flex has successfully completed a couple of acquisitions, they are increasingly seen as a potential “landing spot” for smaller fintechs that haven’t yet found full product-market fit. This has led to inbound interest from fintech VCs, creating a valuable sourcing channel.

Crucially, Ryan underscores the importance of customer validation. If multiple customers indicate they would buy the combined offering, it significantly de-risks the acquisition and provides confidence in the strategic fit. Avoid acquisitions driven by ego rather than genuine customer and growth potential.

The takeaway: Conduct thorough upfront due diligence on the target’s funding, board, and leadership. Prioritize companies with strong strategic alignment and clear customer demand for the combined offering. Leverage your network and industry relationships for sourcing potential targets.

Negotiating the Deal – Structuring Deals & Aligning with Sellers

For early-stage companies with limited capital, creative deal structuring is essential. Ryan and Zaid shared practical examples.

Ryan highlighted using a mix of raised capital, venture debt, and stock in their acquisitions. He even shared an example where acquiring a company with cash on its balance sheet for all stock provided them with the capital to fund a subsequent cash-plus-stock acquisition of a complementary business. This demonstrates the potential for resourceful deal-making. He also emphasized the need to consider your desired level of involvement with the acquired founder when structuring stock deals.

Zaid elaborated on leveraging the target’s balance sheet as a form of capital, potentially offering preferred equity with significant future upside to the sellers’ investors. This aligns incentives for long-term growth. He also noted that deals involving stock can mitigate risk for the buyer and offer sellers a “second bite of the apple”.

Ryan also pointed out the potential for more practical and lower valuations in markets like the UK, offering opportunities for savvy acquirers.

The takeaway: Be creative and explore various deal structures beyond just cash, including stock, debt, and leveraging the target’s own assets. Understand the motivations of the sellers and structure the deal to align incentives for future success.

Executing the Transaction – Timelines, Key Players & Surprises Along the Way

Once a deal is agreed upon, the execution phase begins. Ryan outlined their disciplined process, which includes light due diligence before the Letter of Intent (LOI) and deeper diligence afterward. Involving the CEO early post-LOI is crucial for seamless integration planning. They also prioritize drafting the purchase agreement early and maintaining daily communication with the target to ensure a swift process.

Ryan stressed the importance of internal PR and continuous reinforcement of the “better together” narrative throughout the integration process. For first-time acquirers, he advises trusting customer validation and your own brand’s appeal to attract and integrate the acquired team.

Both Ryan and Zaid emphasized the inevitability of unexpected problems arising post-closing, even with thorough due diligence. The key is to have a good relationship with the acquired team and a willingness to work through these challenges collaboratively. A well-defined and standardized onboarding process, as implemented by Flex, is crucial for smoothly integrating new team members and aligning cultures.

The takeaway: Establish a clear and efficient process for due diligence and integration. Prioritize clear communication and build strong relationships with the acquired team. Be prepared for unforeseen challenges and have a plan for addressing them.

Post-Acquisition Realities – Culture Shifts, Integration Challenges & Unexpected Wins

Integrating two companies can be complex. Culture clashes and differing operational processes are common challenges. Zaid shared Flex’s approach of distributing engineering teams across different “pods” to foster cross-pollination of cultures. Regular surveys can help gauge employee sentiment and address any emerging issues.

Retaining key talent from the acquired company is vital. Both Ryan and Zaid emphasized the importance of careful vetting for cultural fit during the interview process. Offering key individuals P&L ownership or demonstrating the potential future value of their stock can be effective retention strategies.

Despite the challenges, successful integrations can lead to significant wins, such as access to new talent with specialized skills and the acceleration of product roadmaps. Ryan’s experience with running a dual-track strategy and divesting a less successful business line highlights the agility and risk mitigation that strategic M&A can offer.

The takeaway: Be mindful of potential culture clashes and proactively implement strategies for integration. Focus on retaining key talent through clear communication, alignment of incentives, and opportunities for growth.

Advice for Founders – What They Wish They Knew Before They Started

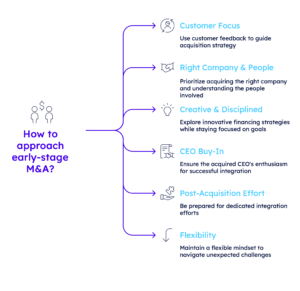

Drawing on their experiences, Ryan and Zaid offered valuable advice for founders considering their first acquisition:

At Companyon Ventures, we believe thinking strategically about M&A can unlock significant growth potential even at an early stage. Don’t shy away from considering M&A as a growth lever. It can be a powerful way to accelerate your trajectory, even with limited resources. By effectively understanding the “build vs. buy” equation, aligning your stakeholders, finding the correct targets, structuring deals creatively, and navigating the post-acquisition realities, you can turn acquisitions into a powerful tool for scaling your B2B software company towards that outsized Series A valuation and beyond.

Next Steps: Consider your current product roadmap and customer needs. Are there any key capabilities that could be acquired more efficiently than built? Start exploring potential synergies with companies in your space. Even initial, informal conversations can open up new strategic possibilities.